Knowing how to maximize Social Security benefits for a married couple is an essential part of financial planning, especially because it can help you receive more benefits, pass along a greater amount of assets to your heirs, or reduce your taxes if you play your cards correctly. The best strategy for optimizing your Social Security benefits depends on your unique financial circumstances as a couple.

In this blog post, we’ll discuss three ways to make the most of your Social Security benefits based on your personal situation.

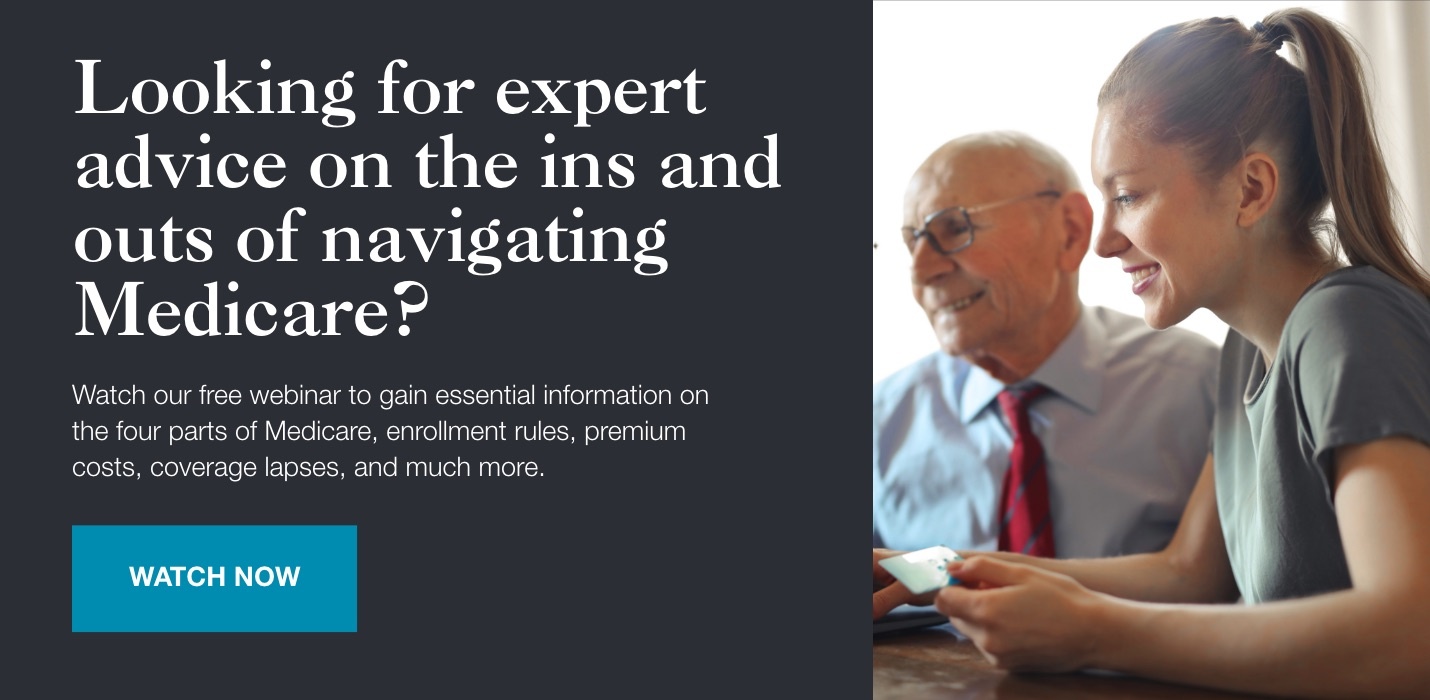

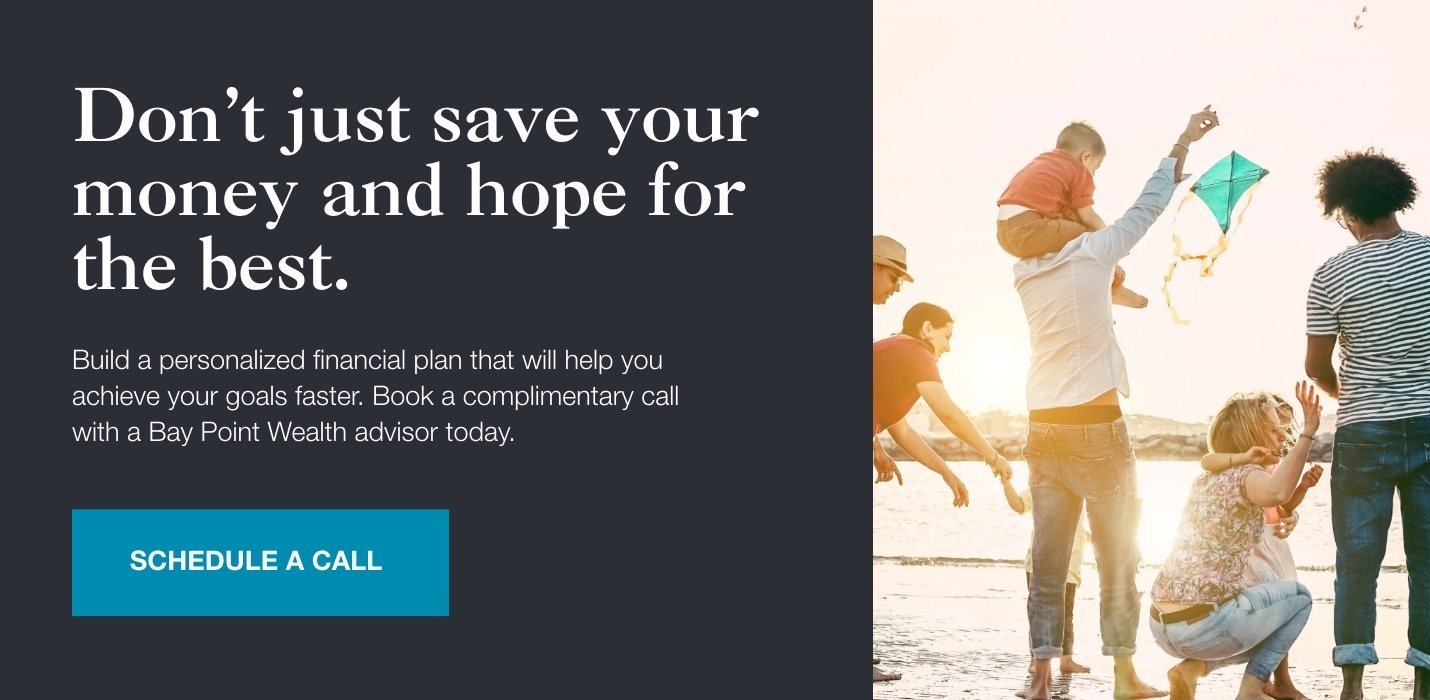

Are you and your spouse seeking a personalized financial plan for your future? Book a call with a Bay Point Wealth advisor to get started.

How To Maximize Social Security Benefits For A Married Couple: 3 Strategies

The amount of Social Security benefits received varies for each couple and depends on factors such as the earnings of each spouse during their working years, the actual income of each spouse (if applicable), and the age that each spouse decides to begin claiming their benefits.

Understanding how to maximize Social Security benefits for a married couple also depends on how much your other investments have accumulated for retirement and in what type of accounts those investments are saved.

Check out these three strategies to help you and your spouse maximize these benefits:

1. Delay both of your Social Security claims and wait for larger benefits.

The longer you and your spouse wait to claim your Social Security benefits, the greater monthly payout you’ll each receive. If you begin taking Social Security at age 62 instead of age 70 (when you must claim it), your benefits will be reduced by 25% of the amount you’d receive at your full retirement age. For example, if you’re eligible to receive $1,000 per month in Social Security at age 66, you’ll receive only $750 per month if you claim it at age 62.

Starting at your full retirement age, your Social Security benefits grow by 8% per year, so it may be best to wait until age 70 to make your claim. The longer you live, the greater the benefit you will receive from delaying your claim, so one exception to this advice is that if you’re in poor health, you may want to claim your benefits earlier.

2. Claim one spouse’s Social Security benefit early and allow the other benefit to grow.

If you and your spouse are going to significantly rely on Social Security in retirement, and one spouse is eligible for a larger benefit, consider delaying that claim to allow the benefit to continue to grow while accepting the other spouse’s smaller benefit. This will provide some protection if you outlive your life expectancy.

If Social Security is your only source of income as a retired couple, you will not have to pay tax on your benefits. However, you could end up paying taxes on 85% of your benefits if your income (which includes half of your benefits) is greater than $44,000. Speaking with a financial advisor who can consider your total financial picture and is knowledgeable about minimizing taxes in retirement is a wise move.

3. Withdraw money from your investment accounts strategically.

If you and your spouse can delay claiming Social Security benefits until age 70, you can become even more strategic with retirement and tax planning if you have investments in various accounts.

For example, you and your spouse have investments in cash or other taxable (non-retirement) accounts, investments in an individual retirement account (IRA), and Social Security benefits. In that case, we suggest considering the following approach:

- If you retire at age 62, use your cash investments to provide income until age 70, as you won’t have to pay tax on those funds. This will allow your Social Security benefits to continue to grow.

- Begin converting money from your traditional IRA into a Roth IRA—also until age 70. Once converted into a Roth IRA, your money will grow on a tax-free basis and will not be subject to required minimum distributions at age 72.

- When you reach age 70, you’ll have likely exhausted your cash investments, but your Social Security Benefits have grown each year, and you have reduced your taxes and generated tax free growth. Now your Social Security benefits will be tax free because you won’t have another source of income.

Navigate Social Security With Bay Point Wealth

Learning how to maximize Social Security benefits for a married couple can be complex. Our team of seasoned financial advisors can help walk you and your spouse through the process, so you’ll be confident that you’re making the right decisions for you as a couple. Assessing your current financial situation and determining the best time to start claiming your Social Security benefits can also ensure you don’t pay more at tax time than necessary.

If you and your spouse are ready to start planning for your financial future, schedule a call with a Bay Point Wealth advisor today.