Did you know that sixty-eight million people have bad credit scores? Unfortunately, low credit scores can make your life difficult in a lot of ways. They can make it challenging to apply for mortgages, credit cards, and other types of loans. It’s tough to take advantage of a line of credit with a poor credit score, but it’s not impossible.

All you need to do is know is where to look for suitable lenders. We’ll walk you through how to secure a line of credit when you have no credit or your score is low. Let’s get started!

What is Considered a Bad Credit Score?

The first thing you should check when looking for a line of credit is your credit score. A credit score is a rating that lenders use to determine whether you’re a reliable borrower. These ratings are typically determined by FICO, or the Fair Isaac Corporation, model of scoring. If you have a low credit score, then it likely means that you miss payments often.

So, what factors affect a credit score? A credit score is split into a variety of areas, each with its percentages. For example, 35% of your credit score is based on your payment history on past credit. FICO considers 30% of the score by the amount you owe, and your credit history’s length makes up 15%.

The final 20% is divided between the amount of new credit you have and the amount of existing credit. When all of these factors are tallied up, you get a score. The range of scores fall into these categories:

- 800 to 850 is an excellent credit score

- 740 to 799 is a very good credit score

- 670 to 739 is a good credit score

- 580 to 669 is a fair credit score

- 300 to 579 is a poor credit score

Generally, fair and poor credit scores are in the bad range of credit score rankings. If you want to learn more about your credit score and how it works, then make sure to check out this resource here.

What is a Line of Credit?

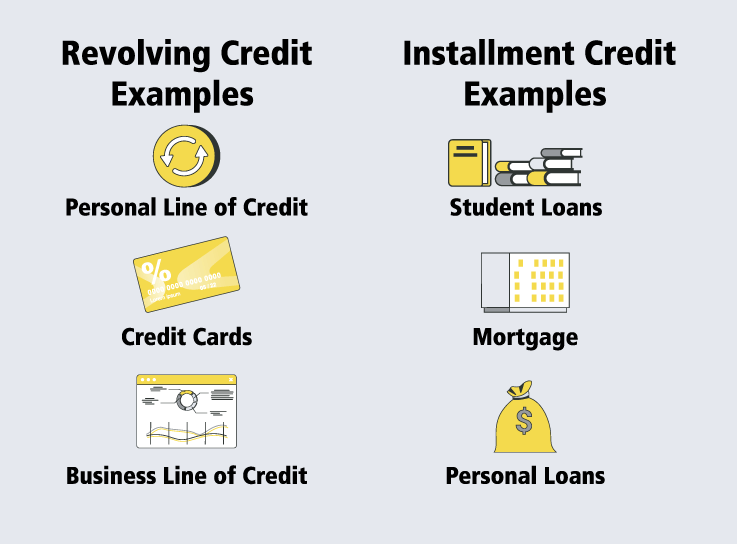

A line of credit is an option that allows you to access the amount of cash that you need. When it comes time to pay, you only owe interest in the amount you borrow. Many different lenders utilize this type of lending option since it often works as a flexible loan.

Once you withdraw money from your account, you can either pay it back immediately or extend it out over a specified period. This type of lending option is often more sought after than credit cards since it gives you access to funds when you need them without applying for a loan.

Make sure to read our line of credit FAQs for more details. If you need cash for an emergency, you can easily access funds. However, like credit cards, a line of credit does require monthly payments.

Secured Line of Credit Vs. Unsecured Line of Credit

There are two popular types of lines of credit: secured and unsecured. Secured lines of credit provide the lender with a lien to an asset that the borrower owns. That means that if the borrower defaults on payments, then the lender can seize this asset. Often this collateral comes in the form of a home or a car.

Secured credit is easy to get, and the interest rates are lower. However, if you aren’t able to make payments, then it can backfire on you. Lenders who issue unsecured lines of credit, on the other hand, can’t seize your assets if you default on payments.

Because of this, unsecured lines of credit are riskier for lenders. As such, they often have higher interest rates.

How to Get a Line of Credit with Poor Credit

So, you found out you have a bad credit score. The good news is that this isn’t the end of the world. It’s still possible to get different types of lines of credit even if your score isn’t great. In this section, we’ll walk you through how to do it.

1. Know Your Credit Score Before Going Into the Process

As we mentioned, it’s important to know your credit score before you begin looking for options. This will give you an idea of what to expect when it comes to lenders. If you fall in the FICO credit score’s poor or fair sections, it’s considered bad credit. Most lines of credit options can cater to people with scores of 550 or higher.

However, keep in mind that many of these options come with interest rates higher than traditional loans. Or, you will receive a small limit. That’s due to the high-risk nature of lending to someone with a bad credit score. So, what should you do if you have a score below 550 and still want a personal line of credit? If your credit score is low, you can check out these tips on boosting your credit score.

2. Use Any Assets As Collateral For a Line of Credit

If you want to avoid higher rates, then consider putting your property up as collateral. This can lead to lower rates while still maintaining a full line of credit. For example, if you own a home, you can borrow using any equity you have in it for collateral. This is known as a HELOC or a Home Equity Line of Credit.

However, be careful with these types of lines of credit. If you cannot make payments, you can easily lose any asset you put up as collateral. As such, it pays to be financially disciplined, so you don’t overspend with your credit line.

3. Make Payments on Time

Once you get approved for your line of credit, you must stay on top of your repayment schedule. If you can, try and make your payments as soon as they occur. That way, your credit improves instead of further decreasing. This is especially important if you have a secured line of credit. If you aren’t careful, you can lose your home, business, or car if you miss a payment.

So, how do you make sure that you stick to your repayment schedule? Try budgeting out the monthly amounts that you make on loan payments. Prioritize these payments over everything else if you can. Remember that if you make your payments on time, then you can also increase your credit limit in the future.

That means that you can borrow more if you ever need it. If you’re able to make consistent payments, you can also expect your credit history to improve, allowing you to apply for more involved loans.

Have You Been Denied a Line of Credit? Contact CASH 1

We hope this article helped give you some tips on securing a line of credit for poor credit. As you can see, it’s by no means impossible to secure credit when you’re credit history isn’t great. Unfortunately, it will take a little more work to find a lender that’s willing to take a bad credit line of credit.

Most of the time, a bank isn’t likely to approve you for a line of credit if you have poor credit. Luckily, the bank isn’t the only option. Direct online lenders like CASH 1 have higher approval rates. We fund your loan directly. Apply online if you live in Idaho, Kansas, Missouri, Louisiana, or Utah.

For over two decades, CASH 1 has been helping our communities get the financial help they deserve. If you’re interested in exploring your options, make sure to get in touch with us today.

Did you know that sixty-eight million people have bad credit scores? Unfortunately, low credit scores can make your life difficult in a lot of ways. They can make it challenging to apply for mortgages, credit cards, and other types of loans. It’s tough to take advantage of a line of credit with a poor credit score, but it’s not impossible.

All you need to do is know is where to look for suitable lenders. We’ll walk you through how to secure a line of credit when you have no credit or your score is low. Let’s get started!

What is Considered a Bad Credit Score?

The first thing you should check when looking for a line of credit is your credit score. A credit score is a rating that lenders use to determine whether you’re a reliable borrower. These ratings are typically determined by FICO, or the Fair Isaac Corporation, model of scoring. If you have a low credit score, then it likely means that you miss payments often.

So, what factors affect a credit score? A credit score is split into a variety of areas, each with its percentages. For example, 35% of your credit score is based on your payment history on past credit. FICO considers 30% of the score by the amount you owe, and your credit history’s length makes up 15%.

The final 20% is divided between the amount of new credit you have and the amount of existing credit. When all of these factors are tallied up, you get a score. The range of scores fall into these categories:

- 800 to 850 is an excellent credit score

- 740 to 799 is a very good credit score

- 670 to 739 is a good credit score

- 580 to 669 is a fair credit score

- 300 to 579 is a poor credit score

Generally, fair and poor credit scores are in the bad range of credit score rankings. If you want to learn more about your credit score and how it works, then make sure to check out this resource here.

What is a Line of Credit?

A line of credit is an option that allows you to access the amount of cash that you need. When it comes time to pay, you only owe interest in the amount you borrow. Many different lenders utilize this type of lending option since it often works as a flexible loan.

Once you withdraw money from your account, you can either pay it back immediately or extend it out over a specified period. This type of lending option is often more sought after than credit cards since it gives you access to funds when you need them without applying for a loan.

Make sure to read our line of credit FAQs for more details. If you need cash for an emergency, you can easily access funds. However, like credit cards, a line of credit does require monthly payments.

Secured Line of Credit Vs. Unsecured Line of Credit

There are two popular types of lines of credit: secured and unsecured. Secured lines of credit provide the lender with a lien to an asset that the borrower owns. That means that if the borrower defaults on payments, then the lender can seize this asset. Often this collateral comes in the form of a home or a car.

Secured credit is easy to get, and the interest rates are lower. However, if you aren’t able to make payments, then it can backfire on you. Lenders who issue unsecured lines of credit, on the other hand, can’t seize your assets if you default on payments.

Because of this, unsecured lines of credit are riskier for lenders. As such, they often have higher interest rates.

How to Get a Line of Credit with Poor Credit

So, you found out you have a bad credit score. The good news is that this isn’t the end of the world. It’s still possible to get different types of lines of credit even if your score isn’t great. In this section, we’ll walk you through how to do it.

1. Know Your Credit Score Before Going Into the Process

As we mentioned, it’s important to know your credit score before you begin looking for options. This will give you an idea of what to expect when it comes to lenders. If you fall in the FICO credit score’s poor or fair sections, it’s considered bad credit. Most lines of credit options can cater to people with scores of 550 or higher.

However, keep in mind that many of these options come with interest rates higher than traditional loans. Or, you will receive a small limit. That’s due to the high-risk nature of lending to someone with a bad credit score. So, what should you do if you have a score below 550 and still want a personal line of credit? If your credit score is low, you can check out these tips on boosting your credit score.

2. Use Any Assets As Collateral For a Line of Credit

If you want to avoid higher rates, then consider putting your property up as collateral. This can lead to lower rates while still maintaining a full line of credit. For example, if you own a home, you can borrow using any equity you have in it for collateral. This is known as a HELOC or a Home Equity Line of Credit.

However, be careful with these types of lines of credit. If you cannot make payments, you can easily lose any asset you put up as collateral. As such, it pays to be financially disciplined, so you don’t overspend with your credit line.

3. Make Payments on Time

Once you get approved for your line of credit, you must stay on top of your repayment schedule. If you can, try and make your payments as soon as they occur. That way, your credit improves instead of further decreasing. This is especially important if you have a secured line of credit. If you aren’t careful, you can lose your home, business, or car if you miss a payment.

So, how do you make sure that you stick to your repayment schedule? Try budgeting out the monthly amounts that you make on loan payments. Prioritize these payments over everything else if you can. Remember that if you make your payments on time, then you can also increase your credit limit in the future.

That means that you can borrow more if you ever need it. If you’re able to make consistent payments, you can also expect your credit history to improve, allowing you to apply for more involved loans.

Have You Been Denied a Line of Credit? Contact CASH 1

We hope this article helped give you some tips on securing a line of credit for poor credit. As you can see, it’s by no means impossible to secure credit when you’re credit history isn’t great. Unfortunately, it will take a little more work to find a lender that’s willing to take a bad credit line of credit.

Most of the time, a bank isn’t likely to approve you for a line of credit if you have poor credit. Luckily, the bank isn’t the only option. Direct online lenders like CASH 1 have higher approval rates. We fund your loan directly. Apply online if you live in Idaho, Kansas, Missouri, Louisiana, or Utah.

For over two decades, CASH 1 has been helping our communities get the financial help they deserve. If you’re interested in exploring your options, make sure to get in touch with us today.